WHAT HAPPENED? Eamonn Holmes is said to have contacted his first wife to beg her to stop colluding with Ruth Langsford to harm him: ‘He pleaded with her not to give those DISGUSTING tapes to Ruth, otherwise he would commit su*c!de out of shame’

Eamonn Holmes and Anthea Turner buried the hatchet after years of animosity.

But Ruth Langsford appeared to be unhappy over their newfound peace six years before they announced their split.

The GB News presenter and Anthea shared the GMTV spotlight from 1994 until 1996.

When Anthea made a sensational exit amid rumours of friction with the show’s chiefs over her “ambition and vanity”.

Reflecting on those tumultuous times during her extensive career in

television, Anthea described her departure as sparking a venomous rift with Eamonn.

Speaking candidly on the Miranda Holder Weekly Fashion Podcast, Anthea opened up about feeling let down by the higher-ups at ITV.

Who cast her as the “ruthless” woman in the narrative. “Revenge is a dish best served sweet. Best of all, I’m still here. I thought it was sad. I just wanted to do the job I enjoyed, but unfortunately the roles have to be labelled,” she disclosed.

Anthea lamented the double standards she faced, being vilified for her ambition while her male counterparts were praised. “I was always asked if I was ambitious and, if I said yes, I was made out to be a ruthless person who would walk over anybody to get where I wanted. It would be said that I was hormonal, or I was stamping my feet,” she revealed.

She highlighted the disparity in treatment, noting that such labels were never applied to her male peers like Eamonn or Phillip Schofield. “You’d never hear anyone say that about Eamonn or Phillip Schofield. No, they’re just doing their job.”, reports the Mirror.

Reflecting on her past with GMTV, Anthea Turner confessed harboring some resentment against Eamonn Holmes, feeling a sense of “injustice” from their well-publicised clash. “I think as you get older, you look back and smile. It’s more like water off a duck’s back now,” she reminisced.

“Nobody likes injustice, nobody wants to be misrepresented. It hurts, it really hurts.”

In a bid to bury the hatchet, Eamonn extended an olive branch in 2005, leading to a 2018 This Morning interview where Anthea joined him and his wife, Ruth Langsford. Tensions evidently soared live on-air when conversation veered towards maintaining friendships with former partners.

The Blue Peter alum light-heartedly referred to her and Eamonn as once being “telly husband and wife”, eliciting a visibly miffed reaction from Ruth who stated firmly that her marriage was the genuine article.

During the interaction, Eamonn attempted to ease the atmosphere. “You are an ex of mine and we’re on good terms, some people think we hate each other! ” he quipped.

But when Anthea agreed, remarking, “And Ruth’s not bothered at all,” it did little to thaw Ruths cool demeanour, as she sharply replied, “Well, we’re married, properly married,” only for Anthea to promptly join in, “Ah but we were telly husband and wife.”

The debate on the studio set heated up when the topic of remaining chummy with an ex came up. Anthea Turner was quick with her take, “I think people are forgetting there’s the sexual relationship and the friendship. If you were and are friends, there’s a problem and there’s a break, you can get back to the normality of friendship,” she stated.

Nonetheless, Ruth Langsford took a contrasting stance, implying a potential underlying sentiment in Eamonn’s amicable ties with Anthea. She contended that staying friends might be a sign of not fully letting go: “I think I’ve made that quite clear. They’re my exes. If I met them in a room I’d be perfectly friendly but I don’t want them in my life. That’s done thank you very much,” she declared, visibly agitated.

Follow us to see more useful information, as well as to give us more motivation to update more useful information for you.

Source: CNN

Understanding Deductibles in Insurance

What is a Deductible?

A deductible is the amount of money a policyholder must pay out-of-pocket before an insurance company begins to cover the remaining costs. Deductibles are a fundamental component of most insurance policies, including health, auto, home, and business insurance.

How Do Deductibles Work?

When you file a claim, you are responsible for paying the deductible amount. Only after this amount is paid will the insurance company pay for the covered expenses exceeding the deductible. For example, if you have a $1,000 deductible on your car insurance and incur $3,000 in damages from an accident, you would pay the first $1,000, and the insurance company would cover the remaining $2,000.

Types of Deductibles

Why Do Deductibles Exist?

Choosing the Right Deductible

When selecting an insurance policy, choosing the right deductible is crucial. Here are some considerations:

Impact on Premiums

The relationship between deductibles and premiums is inverse. Generally, the higher the deductible, the lower the premium, and vice versa. This trade-off allows policyholders to customize their insurance based on their financial situation and risk appetite.

Conclusion

Deductibles are a key feature of insurance policies that influence both the cost of premiums and the financial burden on policyholders when filing claims. Understanding how deductibles work and carefully selecting an appropriate deductible can help balance cost savings with financial protection, ensuring optimal insurance coverage tailored to individual needs and circumstances.

- Fixed Dollar Deductible: This is a specific amount you must pay each time you file a claim. It’s common in health and auto insurance policies.

Percentage Deductible: In some cases, particularly with homeowners insurance, the deductible might be a percentage of the insured value. For instance, if your home is insured for $200,000 and you have a 2% deductible, your out-of-pocket cost would be $4,000 before insurance covers the rest.

Per-Claim vs. Annual Deductible:

Per-Claim Deductible: You pay the deductible every time you file a claim.

Annual Deductible: Common in health insurance, this deductible resets each year. You pay out-of-pocket until your total expenses reach the deductible amount for the year.

- Cost Control: Deductibles help keep insurance premiums more affordable. Higher deductibles typically result in lower premiums because the policyholder assumes more initial risk.

Reduced Claims Frequency: Deductibles discourage policyholders from filing small or frivolous claims, reducing the number of claims an insurer must process and pay out.

Shared Responsibility: Deductibles ensure that policyholders share in the financial responsibility of their care or damages, promoting cautious behavior and maintenance of insured assets.

- Financial Ability: Assess your ability to pay the deductible in case of a claim. A higher deductible can lower your premium but may be challenging to pay if an incident occurs.

Risk Tolerance: Determine how much risk you are comfortable assuming. If you prefer lower out-of-pocket costs during an emergency, a lower deductible might be preferable, albeit with a higher premium.

Frequency of Claims: Consider how often you might need to file a claim. If you anticipate frequent claims, a lower deductible might be more cost-effective over time.

News

BIG EXPLOSION at the royal family: Harry revealed he called for this ‘mysterious’ person after receiving a ‘fierce att@ck’ from William: ‘That person promised to help me defeat William and ‘destr*y’ the king Jia, that damn nest!’ K

BIG EXPLOSION at the royal family: Harry revealed he called for this ‘mysterious’ person after receiving a ‘fierce att@ck’ from William: ‘That person promised to help me defeat William and ‘destr*y’ the king Jia, that damn nest!’ Prince Harry has…

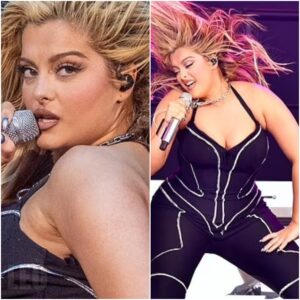

SHOCK: Bebe Rexha says she “could destr*y a significant part of the entertainment industry” with what she knows, but she can’t reveal it because of these terrible threats!K

SHOCK: Bebe Rexha says she “could destr*y a significant part of the entertainment industry” with what she knows, but she can’t reveal it because of these terrible threats! Four-time Grammy nominee Bebe Rexha revealed she is ‘fed’ up with the…

Ruth Langsford and Eamonn Holmes’ circle of friends is ‘traumatized’ after evidence revealed by Eamonn’s lover Katie: ‘OMG, it turns out Ruth is that DISGUSTING person’ .K

Ruth Langsford and Eamonn Holmes’ circle of friends is ‘traumatized’ after evidence revealed by Eamonn’s lover Katie: ‘OMG, it turns out Ruth is that DISGUSTING person’ It’s also causing a rift in the showbiz world with camps forming on both…

SHOCK: Prince Harry’s ‘scam’ to buy the Tillman award, which he needed to continue his visa requirements, was exposed by his own wife, Meghan Markle – Their ‘gala event’ lifestyle surrounded by Hollywood stars is also exposed because it’s dirtier than you think!K

SHOCK: Prince Harry’s ‘scam’ to buy the Tillman award, which he needed to continue his visa requirements, was exposed by his own wife, Meghan Markle – Their ‘gala event’ lifestyle surrounded by Hollywood stars is also exposed because it’s dirtier…

Ruth Langsford REVEALS she is seeking help from friends to expose Eamonn Holmes and his lover, Katie: ‘He dared to let her meet my son alone and give him those DISGUSTING things to watch!’K

Ruth Langsford reveals she is seeking help from friends to expose Eamonn Holmes and his lover, Katie: ‘He dared to let her meet my son alone and give him those DISGUSTING things to watch!’ The couple announced their marriage had…

SHOCK: Tom Cruise was seen with a painful injury on his hand after returning from a visit with his daughter Suri. When asked about it, Tom remained silent, but his sister Marian revealed the shocking truth: ‘Suri is a d3vil!’K

SHOCK: Tom Cruise was seen with a painful injury on his hand after returning from a visit with his daughter Suri. When asked about it, Tom remained silent, but his sister Marian revealed the shocking truth: ‘Suri is a d3vil!’…

End of content

No more pages to load